Decree on tax classification of foreign entities published

On 13 November, the Dutch government published a decree on the comparison of foreign entities which provides a framework for the tax classification of foreign entities as either transparent or non-transparent for Dutch tax purposes under the new classification rules which will enter into force on 1 January 2025. In this Tax Alert we discuss the content of the decree, the list of presumed classifications annexed to the decree and some remaining questions and unclarities.

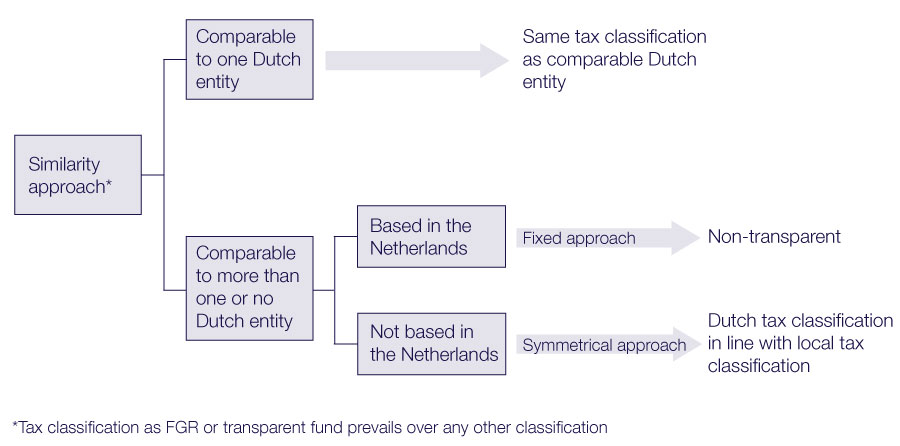

On 1 January 2025, new rules for the classification of foreign entities as either transparent or non-transparent for Dutch (corporate) income tax and withholding tax purposes enter into force. As a starting point, it needs to be assessed under these rules whether a foreign entity has a Dutch equivalent (the “similarity approach”). If so, the tax classification of the entity’s Dutch equivalent will be applied. If the foreign entity is not sufficiently comparable with a Dutch entity or if it is comparable with more than one Dutch entity (whereby the Dutch naamloze vennootschap (NV) and besloten vennootschap (BV) are considered as one and the same entity), either the “fixed approach” or the “symmetrical approach” applies. The fixed approach applies to foreign entities located in the Netherlands and classifies a foreign entity as non-transparent for Dutch tax purposes (if the similarity approach did not provide a classification). For foreign entities located outside of the Netherlands, the symmetrical approach applies, meaning that the tax classification of the jurisdiction where the entity is located, will be followed for Dutch tax purposes. We also refer to our Tax Alerts of 21 September 2023, 4 April 2024 and 19 September 2024.

On 13 November, the Dutch government published a decree on the comparison of foreign entities (Besluit vergelijking buitenlandse rechtsvormen; the “Decree”) which provides a framework for the application of the similarity approach. The decree contains the fundamental characteristics of both Dutch non-transparent entities (such as the NV, BV, and coöperatie (Coop)) and transparent partnerships (such as the commanditaire vennootschap (CV) and maatschap). The similarity of a foreign entity to a Dutch entity is assessed based on the nature and organisation of the legal form. The civil law characteristics of the foreign legal form serve as a starting point of the classification. This means that, apart from the establishment of the foreign entity, a variety of other features are also of relevance. These features include the relationship between the entity and its participants, the liability of the participants and the management structure of the entity. All features are then compared to the fundamental characteristics of the various Dutch entities and partnerships included in the Decree, in order to assess whether the foreign entity has a Dutch equivalent. It is noted that if the foreign entity meets the definition of a Dutch fund for joint account (fonds voor gemene rekening or FGR) or tax transparent fund, then such foreign entity is considered comparable to an FGR or tax transparent fund. For purposes of the similarity approach, the tax classification as FGR or tax transparent fund prevails over any other classification.

A list (rechtsvormenlijst) with legal presumptions regarding the comparability of certain foreign entities is annexed to the Decree. The comparability of the entities in this list is based on the similarity approach as described in the Decree. The list contains a number of foreign entities and their (presumed) Dutch equivalent, as well as foreign entities which can (presumably) not be compared to any Dutch legal form. Examples of foreign entities included in the list are the US LLC, which is (presumed to be) comparable to a Dutch NV or BV, and the US LLP and UK LLP, both (presumed to be) non-comparable to a Dutch entity or partnership.

Current rules vs new rules

Under the current rules, the classification of foreign entities as either transparent or non-transparent for Dutch (corporate) income tax and withholding tax purposes is based on an assessment of certain (civil law) characteristics of the respective foreign entity. However, in principle only the following four criteria are taken into account for the classification of foreign entities, which makes the current classification rules simpler than the new rules. The current criteria are laid down in questions on (i) the possibility of legal ownership, (ii) the liability of the participants, (iii) the way the capital of the entity is divided and (iv) whether accession or substitution of a limited partner requires unanimous consent of all (general and limited) partners. Especially the last question is rather unique to the Netherlands. Given its uniqueness, the current rules have a higher chance of resulting in hybrid mismatches, which the government tries to remedy with the new classification rules.

However, the Decree includes more criteria in the form of fundamental characteristics, which can create uncertainty for taxpayers as to the qualification for Dutch tax purposes. In particular, it is unclear how many of the fundamental characteristics in the Decree have to be comparable in order for the foreign entity to qualify as being comparable with a Dutch entity or partnership. In this respect it is stated in the explanatory notes to the Decree that all fundamental characteristics listed in the Decree are of equal importance, but in assessing the classification of a foreign entity, more or less significance may be given to certain characteristics, depending on the case at hand. In addition, according to the explanatory notes to the Decree, a variation or deviation from one or more of the fundamental characteristics does not necessarily lead to the conclusion that the foreign entity is not comparable to a Dutch entity or partnership. Furthermore, Dutch partnerships do not have legal personality, but this is not listed as one of the fundamental characteristics of a Dutch partnership, meaning that foreign entities with legal personality can still be compared to partnerships and classify as transparent for Dutch tax purposes. Finally, it is mentioned in the explanatory notes that not only the fundamental characteristics as stated in the Decree are relevant for the comparison of entities, but also the intent of the legislator. The intent of the legislator may be difficult for taxpayers to determine.

Status of presumed classifications

As mentioned above, the Decree comes with a list of foreign entities and their presumed classification. The explanatory notes to the Decree state that the list provides an indicative classification, with a reservation for relevant changes of the foreign law that governs the foreign entity since the moment the foreign entity was classified. The classification given to a legal form in the list can be set aside if an assessment on the basis of the fundamental characteristics as laid down in the Decree provides for a different outcome either in general or in a particular case. The burden of proof that the presumption of comparability included in the list is incorrect rests on the one who challenges the presumed classification.

Funds for joint account (FGR)

As a final point in this alert, we note that the tax classification rules for Dutch FGRs will also change as of 1 January 2025. An FGR will only maintain its non-transparent status if (i) it is an investment fund or UCITS regulated by the Dutch Financial Supervision Act and (ii) if the participations in the FGR are tradeable. Classification as an FGR does not require a certain legal form.

As indicated above, pursuant to the Decree the classification as an FGR will always prevail over other classifications, which means that these new classification rules will also impact foreign equivalents of the FGR. For instance, foreign investment entities comparable to a Dutch limited partnership (CV) and treated as transparent in the relevant foreign jurisdiction, will be classified as non-transparent for Dutch (corporate) income tax and withholding tax purposes if such entity meets the definition of an FGR. This could obviously result in (new) hybrid mismatches.

In conclusion, while the aim of the Decree is to result in less international classification mismatches and more legal certainty for taxpayers, in practice taxpayers may still be left with new questions and mismatches may persist or new mismatches may arise.